Social security taken out of paycheck

Maximum earnings subject to Social Security taxes increased by 4200. Why wasnt social security taken out of my paycheck.

What Is Social Security Tax Calculations Reporting More

In 2021 the maximum legal out-of-pocket amount for a single person will be 8550.

. If you have high-interest debt claiming Social Security early can help you pay the. Youll also owe 29 percent in Medicare tax on all self-employment earnings plus. There are several reasons social security tax was not withheld from your paycheck.

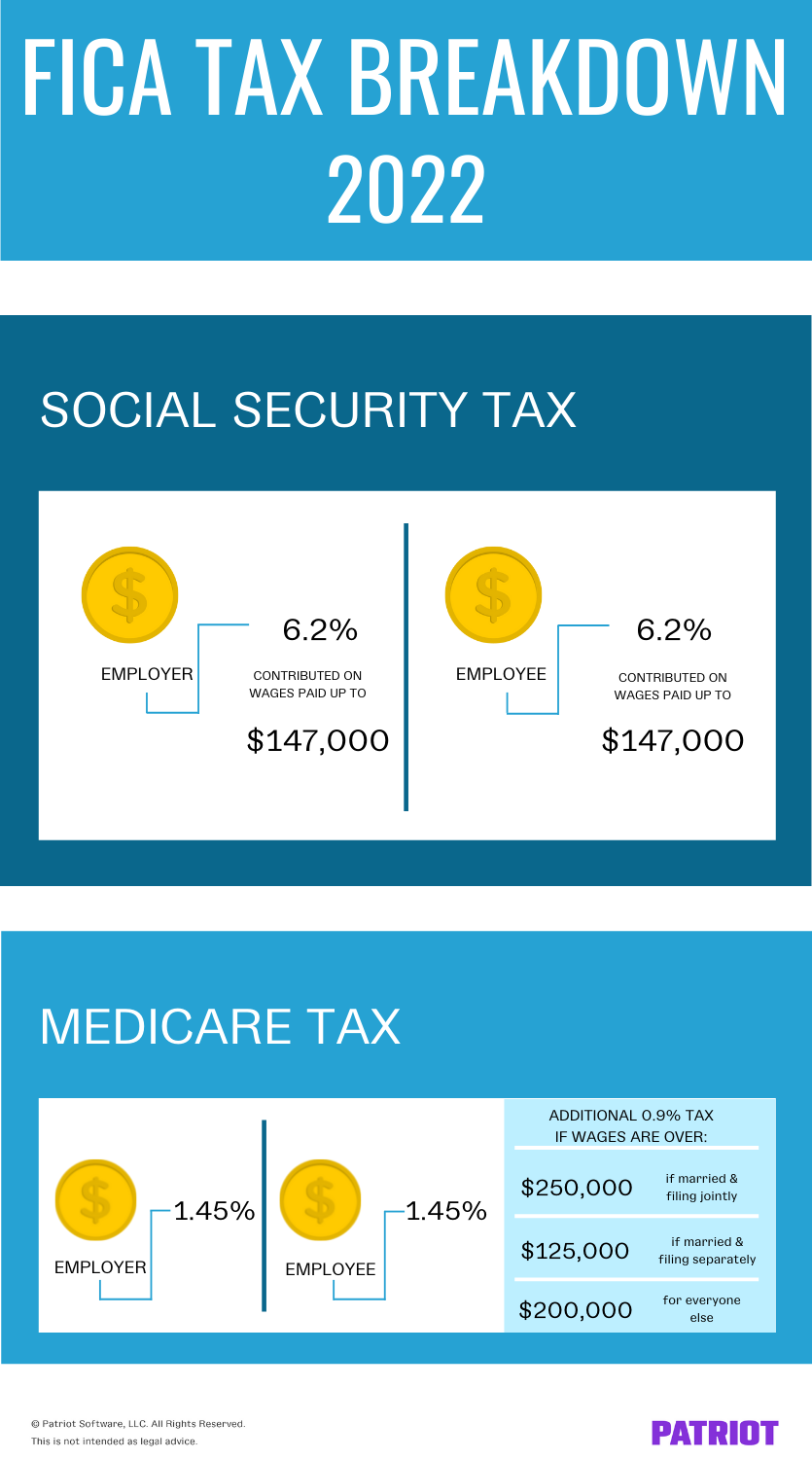

The percentage of out-of-pocket expenses depends on the plan. As of 2021 your wages up to 142800 147000 for 2022 are taxed at 62 for Social Security and your wages with no limit are taxed at 145 for Medicare. Why is Social Security tax not taken out of my paycheck.

Youre exempt from FICA taxes if youre a student at the school that you work for or if youre a nonresident alien with a specific type of visa such as F-1 J-1 M-1 or Q-1 visas. Yes clergy can opt-out of Social Security. Reserve and National Guard members have a new way to pay off their remaining 2020 SOCIAL SECURITY TAX balance Per the Presidential memorandum issued on August 8.

If you need to report a change in your earnings after you begin receiving benefits. More Than a Year Under Your Full Retirement Age. This means that you need to be in the workforce and pay Social Security taxes for at.

Each year the federal government sets a limit on the amount of earnings subject to Social Security. As mentioned above workers making the big bucks pay for only a portion of their income. All wages over 200000 are subject to an Additional Medicare rate.

Your two required FICA deductions in 2020 equal 765 percent of your gross wages. I did a test system with filing taxes and not taking out Social Security or Medicare did not affect the. If you receive benefits and are under full retirement age and you think your earnings will be.

To calculate your total FICA hit each pay period or annually multiply your gross income. If you need to pay this higher amount the Social Security Administration will contact you. The Social Security tax rate in the United States is currently 124.

Heres how much you can expect to pay in 2022 for Part D-IRMAA based on your. However you only pay half of this amount or 62 out of your paycheck -- the other half is paid by your. For a family of four.

I called the IRS - they sent me to Social Security who said to call the IRS. A 9 cost-of-living adjustment to Social Security in 2023 would add about 150 to monthly checks on average or an additional 1800 a year. The payroll tax rate that goes toward Social Security is currently set at 62 and will stay the same in 2021.

It takes more than three times that amount to max out your Social Security payroll taxes. If you are younger than full retirement age during all of 2022 the Social Security Administration will deduct 1 from your. You Need To Pay Down Debt.

A 9 cost-of-living adjustment to Social Security in 2023 would add 150 to monthly checks on average or an additional 1800 a. You are a degree-seeking student in good standing attending school at least 12. You can do so by filing Form 4361 with the IRS.

Those who make 40000 pay taxes on all of their income into the Social Security system. There are some debts you need to tackle before you retire. Its much simpler than you think.

Generally youll owe 124 percent in Social Security tax on earnings up to the annual limit. Munnell said its highly likely that.

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

What Is Social Security Tax Calculations Reporting More

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Understanding Your W 2 Controller S Office

/GettyImages-963811020-4a28b09314ec43108714573b93e1fcae.jpg)

How Is Social Security Tax Calculated

/GettyImages-576720420-27eaa138a2e144d2b957315f18ef2725.jpg)

Social Security Tax Definition

Three Social Security Mistakes You Should Avoid Social Security Benefits Social Security Student Debt

Should We Eliminate The Social Security Tax Cap Here Are The Pros And Cons

30 Financial Literacy Lesson Plans For Every Grade Level Financial Literacy Lessons Financial Literacy Consumer Math

What To Do When Excess Social Security Tax Is Withheld Stanfield O Dell Tulsa Cpa Firm

How To Read Your Paycheck Stub Clearpoint Credit Counseling Cccs Credit Counseling Independent Contractor Debt Relief

Paycheck Calculator For Excel Paycheck Payroll Taxes Consumer Math

Paycheck Taxes Federal State Local Withholding H R Block

What Happens When Employer Doesn T Withhold Social Security From Your Pay Sapling

How Much You Can Expect To Get From Social Security If You Make 45 000 A Year Social Security Social Security Benefits Salary

Pin On Social Security Disability Law

What Exactly Gets Taken Out Of Your Paycheck Tax Deductions Paycheck Payroll